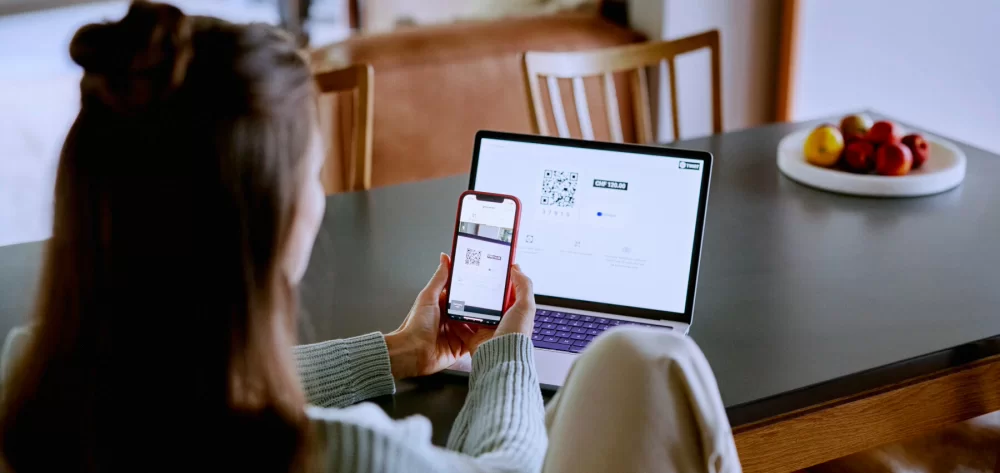

Whether from farm stalls, markets, or street food stands, many people in Switzerland are familiar with the printed QR codes that can be used for Twint payments. The process is simple. You scan the QR code with the Twint app, enter the amount to be paid, and click on the pay button to finalize the transaction. There is no need for the merchant to have a POS terminal or any other special equipment.

Payment links are the digital equivalent of Twint QR codes

With the introduction of payment links, Twint is making a digital version of its QR codes available to users. Merchants can implement payment links in several different ways.

Some examples are:

- Merchants who organize appointments via messaging apps like Whatsapp can send customers payment links directly in the messaging app. The customer can then click on the payment link to make the payment using Twint. Among others, use cases could include paying tutors, music teachers, or sports instructors.

- A sports club or other non-profit organization could include a payment link in their newsletter. Newsletter recipients could then make donations using Twint.

- Sports clubs and other associations could also publish a payment link on their websites to enable donors to contribute immediately via Twint.

- Smaller merchants could send payment links to customers who have completed orders to enable them to pay their bills immediately.

One advantage of payment links over other popular payment methods is that the merchant does not need to integrate an online payment service into their website. The merchant only has to register with Twint and complete a verification process. The standard Twint merchant fee of 1.3 percent applies to payments made using Twint payment links.

Express checkout enables faster purchases

Another new feature that Twint has introduced is aimed at simplifying the process of shopping at a merchant for the first time. The customer can complete the checkout process by clicking on Express Checkout. The customer must then confirm that Twint data like their address can be shared with the online store. This removes the need to enter all of your basic information in the online store’s checkout process.

The Express Checkout service uses the Twint ID, which Twint is reintroducing. This is the first service that requires a Twint ID.

Not all online shops that accept Twint will automatically offer the Express Checkout service. Merchants must specifically choose to activate this service. What is more, the service currently only works with online shops that use either the Magento, Shopware, or Woo Commerce e-commerce platforms.

Conclusion by Ralf Beyeler from moneyland.ch

Twint’s new payment link service can particularly simplify payments for sole proprietorships and other small businesses. It is the digital equivalent of Twint’s QR code payment system. It enables merchants to accept Twint payments without having to install a payment system.

As a customer though, it is important to be wary of phishing attempts. Before you accept a payment link, make sure to check if it actually leads to Twint, and that the recipient is correct.

The Express Checkout service makes online shopping more convenient because you do not need to enter your information again every time you use a new online merchant. The information is transferred directly from Twint. It is worth noting, however, that Twint is not the first service provider to offer this. There are already a number of similar solutions.

More on this topic:

Compare Swiss credit cards now

Merchant fees for accepting cashless payments in Switzerland

Deal of the Day

Deal of the Day