It has become an increasingly common experience: You are visiting a website when a chat box pops up and invites you to get help instead of searching the site for information on your own. Have you also asked yourself what those chat functions can actually do? I decided to get to the bottom of that question by delving into chat services of multiple banking and retirement saving apps.

It is important to keep our expectations realistic. Sensitive data like a forgotten password or my account balance obviously would not be available via chat. Instead, the point of these services is to provide customers with information about services and to help them organize personal consultations.

That is why I chose the following goals when I embarked on my test:

- To find out from banks how much interest I can earn, and whether or not they offer Twint.

- To find out from retirement saving services how using the pillar 3a could benefit me, and how much money I can pay into the pillar 3a.

- To start the process of opening a private bank account or a pillar 3a retirement account at banks and retirement service providers.

- When possible, I also asked some questions in Swiss German to see whether the chat services could handle conversations in Switzerland’s most widely-used language.

I am fairly certain that Swiss banks could easily handle the above-mentioned tasks if I were to visit a branch office in person. Sure, there may be situations in which employees do not have a good level of Swiss German, but even then, we would probably be able to make ourselves understood. But of course, having to visit a bank in person does require more time and effort than visiting their website. And some service providers do not have any offices which are open to the public.

Chatting does not always work

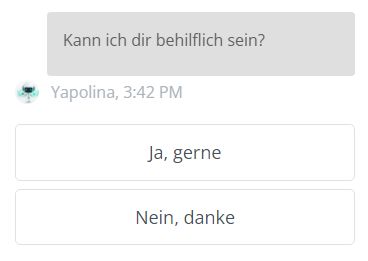

Before we take a detailed look at individual service providers, we have to understand the two fundamental differentiators between individual chat functions. The first: Only half of the chat functions included in my test actually let me chat – that is to say, enter text. The rest of them only let me select options from a limited, predefined selection (see image below).

Image: Option selection instead of chatting

That is probably a lot easier to program, but from a customer perspective it is usually tedious compared to typing in your question in a text box. The reason is that for complicated queries, you have to click your way through a whole menu before you even get to the topic you are interested in. If I have a concrete question to ask, then being offered vague options like “tell me more about the pillar 3a” is hardly satisfactory. I could probably find the needed information faster by simply searching the website using Google.

Human or chatbot?

The second major criterion which differentiates one group of chat services from the other is who or what it is that I am chatting with. In most cases, the customer-service representative is a chatbot which shoots back automatic replies. But some service providers – namely Swissquote (desktop version), Valiant, and Viac – you actually get to chat with real people.

The advantage of chatting with a human is that they normally understand my questions better, and can give me precise answers to concrete questions. The downside is that the waiting times for answers are sometimes notably longer than those of bot-based chat services.

The chat services of banks and retirement saving apps put to the test

Here I provide a short evaluation of the chat functions included in my test, from best to worst:

Format: Text-based chat

Customer support: Human

When I entered my question into the Viac chat service, one of the founders answered me personally. All of my questions were answered quickly and competently, with links to more extensive information. Even my ghastly written Swiss German did not seem to be a problem.

I really don't have any complaints when it comes to Viac’s chat function. The medium is well-serviced and rightly so – as the company told moneyland.ch that its chat service is its most-used means of customer communications. The chat function not only aims to help existing and prospective customers, but also occasionally provides support for customers from third-party service providers. However, your chat partner will not always be one of Viac’s founders – I simply lucked out.

- Swissquote (desktop version): Excellent

Format: Text-based chat

Customer support: Human

The chat-based customer service on Swisssquote’s desktop application connects me to a human customer support representative by default (the company does also have a chatbot which I explain further on). The answers I got were very precise and Swiss German was not an issue. But I did sometimes have to wait fairly long before receiving answers.

Format: Text-based chat

Customer support: Chatbot

The Postfinance chatbot is miles ahead of the other bots I tested for this blog post. I typed my questions in a text box, and the bot reliably understood what I wanted to know. Even Swiss German did not pose a challenge.

The only glitch I encountered was when I told the bot that I wanted to open a pillar 3a account, and it gave me a list of options which included every kind of account other than the one I wanted. But after a few tries using other variations to describe a retirement account, it did eventually pull through.

Format: Option selection

Customer support: Chatbot

With Frankly I had to fight my way through a selection of prefabricated options instead of just typing my question. But in its defense, it was generally clear which option I should select in order to find the information I was looking for. One thing that stuck out to me was an option you could click on if you wanted to take a quiz. It turned out to be a cleverly-packaged advertisement for voluntary retirement planning solutions, which somehow does not seem out of place in a retirement planning app.

At the end when I selected that I wanted to open a Frankly account, the chatbot immediately sent me the matching discount voucher. That is not too special when you consider that the same discount is available to new customers using a code which is openly published on the Frankly website (at least until the end of the year), and with the FRANKLY999 code available on moneyland.ch. But in spite of that, being rewarded at the end of the chat does contribute to a more positive chat experience.

Format: Text-based chat

Customer support: Human

The long waiting times were one thing that struck me about the Valiant chat service. Five-minute waits for answers were not unusual. Most likely, the customer support center was simply overbooked, and personnel had to answer many different inquiries at the same time. That may also have been a reason for the minor grammatical errors. The answers themselves were very good – when they eventually came. When asked by moneyland.ch, Valiant said that it receives around 50 inquiries via its chat function every week, which is relatively few compared to other banks. According to the Zürcher Kantonalbank, for example, the Frankly chat service handles nearly four times that many requests every week, while Postfinance receives more than 10,000 chat-based inquiries.

My questions in Swiss German remained unanswered. When after a ten-minute wait, I closed the first window and opened a new conversation to ask the same question again, Valiant simply closed my chat without any comment. I do not know whether it was a case of a customer service representative who did not understand Swiss German, or if Valiant has a preference for customers who speak High German.

Format: Option selection

Customer support: Chatbot

The Yapeal chatbot could not answer my questions. The information it provided generally seemed very limited. But the bot did refer me to a contact form. If I could not find the information anywhere else, or was simply too lazy to do so, then I would probably have been able to get an answer by email. However, we did not test Yapeal’s email-based customer service for this blog post.

The bot does fulfill its basic task of providing users with information or guiding them to a place where they can get help. Maybe questions about interest rates and Twint are not the kind which are typically asked by Yapeal customers. It is possible that the chatbot may have performed somewhat better with a different set of questions.

- Swissquote (mobile version): Satisfactory

Format: Text-based chat

Customer support: Chatbot

Mobile users are connected to Swissquote’s chatbot. This service was frequently overwhelmed by my questions. It did not understand any Swiss German at all, and it was often almost amusing to see the seemingly random answers with which the bot responded to my questions. Obviously the chatbot is in a pre-release testing phase, and that may well be the reason why my inquiries got next to nowhere.

When I told the bot that I wanted to speak to a human, it did put me through to a suitable customer service representative. So, during Swissquote’s work hours, I could switch to its excellent customer support from real employees (explained further up).

Format: Option selection

Customer support: Chatbot

This chatbot feels more like an advertising vehicle than a genuine digital customer service channel. After clicking on an ominous option inviting me to discover Yuh, I was given the equivalent of a digital catalogue of products. If you have any concrete questions about interest or payment methods, you will have to click through numerous menus in search of answers, and you may not find what you are looking for. For example, even the point covering savings did not list the going interest rates.

Still, under the help option you can find a number of points related to emergencies. For example, you can get instructions to follow if your card is lost or if you are suddenly unable to log in. This information is all available in just a few taps, which is especially practical in emergencies. However, these specific scenarios were not the object of our test, which is why this chatbot received somewhat lower ratings than its contemporaries.

Additionally, moneyland.ch has been informed that a new chatbot with new functions is earmarked for launch in 2023. So Yuh’s poor chat-service rating in this test may simply be a matter of bad timing.

Verdict: What is the real added value?

The best chat-based customer services from Swiss financial services providers let you find basic information and get links which you can follow to take further steps (opening an account, for example). Postfinance has shown that these simple inquiries can be handled without an actual employee. But with the exception of Postfinance, I honestly would rather not have to waste time on chatbots at all. Navigating the menus of predefined options is annoying and hardly intuitive.

Not surprisingly, all of the bots are very good at one thing: Helping customers to open accounts. But with some chatbots you get the impression that opening accounts is pretty much all they are good for.

Chat functions – whether you are talking to a human or a bot – are still more or less an interactive FAQ. If you want investment advice, you still need to make an appointment, and even opening an account cannot be done directly in the chat. In the best case, you can find information somewhat faster, or your complicated questions will be referred to experts or to information on the website. In the worst case, chat services will simply waste your time, and you will still have to phone or write an email to get the information you need.

More on this topic:

Compare Swiss savings accounts now

Swiss retirement saving apps compared

Deal of the Day

Deal of the Day