Back in the autumn of 2024, with hardly any attention from the public eye, Swiss banks and the Swiss payment service provider SIX announced that they would terminate their direct debit service on September 30, 2028. The change affects both LSV+ direct debits for personal accounts, and the BDD direct debit service for business accounts. Postfinance is the only Swiss bank that uses its own direct debit system, the CH-DD Direct Debit scheme (also called Swiss COR1 Direct Debit). Postfinance will continue to offer this service to its customers in the future.

Direct debit orders are practical

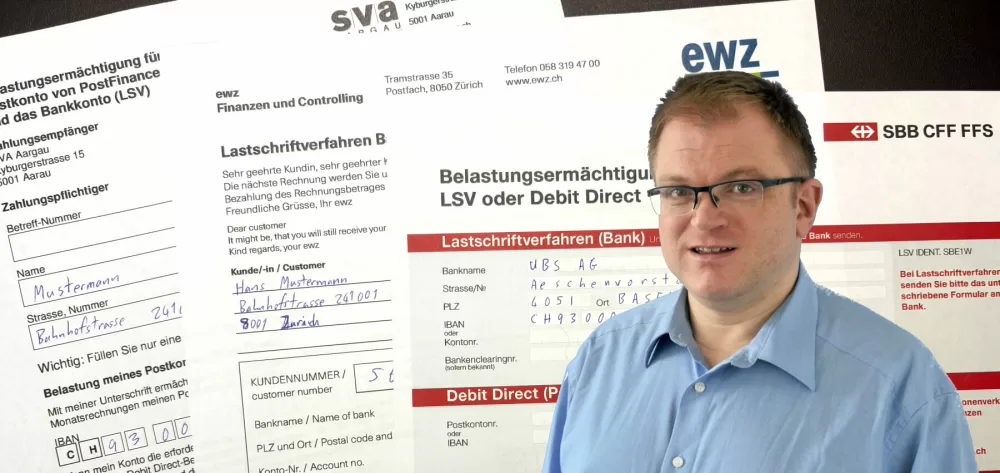

Personally, I find direct debit orders a very convenient tool for paying recurring bills and avoiding late payment penalties. The whole billing process is handled automatically. For that reason, I have direct debit orders for my electricity bills and credit card bills, for example.

A banking service with a long history is drawing to a close

Swiss banks first introduced direct debit orders nearly 50 years ago in 1977. People were already using direct debits when I first entered this world. The service has been adapted over the years in keeping with technological changes. The current LSV+ and BDD systems were introduced in 2005. One of the main reasons cited for the termination of these services is that they no longer meet the current criteria – including international criteria – for payment systems.

No more signatures

The current LSV+ system requires you to sign a direct debit order form on paper when setting up the initial order. According to Swiss banks, that process is now outdated. Personally though, I find that handwritten signatures on paper forms do have one advantage, which is that they are available to all customers – including those who do not use online and mobile banking. That group includes many older people, as well as people who abstain from online banking due to security concerns.

How popular are direct debit orders in Switzerland?

Unlike countries like Germany, where direct debits are very widely used, the use of direct debit orders in Switzerland is relatively low.

I am known for my habit of digging through official statistics, and sure enough, I did find statistics about the use of direct debit orders in Switzerland published by the Swiss National Bank. In recent years, around 65 million bills per year were paid using direct debit orders from Swiss banks and Postfinance.

To add some perspective, Switzerland’s residents made nearly 1.4 billion transfers using online banking in 2024. What is more, around 100 million transfers were still ordered offline. At least for me, the fact that more payments were made on paper than using direct debit orders is pretty surprising.

Are there alternatives for automating recurring payments?

If you like using direct debit orders like I do, you do not need to despair just yet. There are a number of alternatives:

- eBill standing approval: eBill users have had the option of creating a standing approval for some time now. When you create a standing approval for an eBill, all future eBills from the same creditor are paid automatically. Unlike a direct debit order, a standing approval for an eBill only requires your consent. Your creditor is not informed about whether the bill was approved individually, or automatically with a standing approval. Another difference to direct debit orders is that you cannot dispute payments made via eBills with a standing approval. The requirement for using this service is that the merchant or other creditor offers eBills as a payment method.

- eBill Direct Debit: In summer 2025, the eBill service will be extended with a new eBill Direct Debit feature. The new service is comparable to the current LSV+ system, but runs on a digital platform. You can register for eBill Direct Debit directly within the eBill service. Alternatively, creditors can send you an invitation that you can choose to accept. Like the LSV+ system, the eBill Debit Direct service gives you the option of disputing payments drawn from your bank account. In order for you to use this service, the merchant or other creditor must offer eBill Direct Debit as a payment option.

- New offline solutions: Information about an offline solution is still somewhat murky. From a technical standpoint, the eBill Direct Debit service does allow for offline orders. The requirement is that your bank offers a corresponding service. Various Swiss banks are still in the process of deciding whether or not to offer such a service.

Is there anything I should do?

For the moment, you can sit back and relax a bit. There are still three-and-a-half years to go before the LSV+ system is taken down. Until September 2028, you can continue using direct debit orders and your existing direct debits will continue to be drawn from your account automatically. The only requirement is that your creditors continue to accept direct debit orders as a payment method until then. The closer we get to the termination date, the more likely it is that companies will stop offering direct debits.

For bills that can be paid by eBill, you can consider switching to eBills with standing approvals. Soon, you will also have the option of using eBill Direct Debit.

More on this topic:

Direct debit orders in Switzerland FAQ

Deal of the Day

Deal of the Day