Dr Perucca, how would you define alternative investments?

Alternative investments (also known as alternative assets) are a wide plethora of assets outside of conventional capital stocks, bonds, and cash. The term covers tangible assets like precious metals and gemstones, collectibles (art, rare wine and whisky, vintage cars, and antiques, for example), and luxury goods (luxury watches or fashion items, for example). The alternative investment category also includes some financial assets such as private equity, commodities, and peer-to-peer lending.

Alternative investments have been used by ultra-high-net-worth individuals for decades, often making up a significant part of their investment portfolios. One-third of the participants in a Lombard Odier survey of high-net-worth individuals allocate more than 10 percent of their portfolios to alternative investments.

But in recent years, interest in using alternative assets to diversify investment portfolios has grown among retail investors as well.

Why have retail investors shied away from alternative assets?

There are several reasons why retails investors have had difficulty investing in alternative assets in the past:

- High entry barriers: The vast majority of investors cannot afford to buy a Patek Philippe Grand Complications for over 68,000 francs or a roughly 480,000-franc copy of Salvador Dali’s Hidden Faces.

- Specialized expertise and handling: How do you go about verifying the authenticity and condition of an asset? How do you handle the storage and maintenance of a Macallan whisky cask or a Ferrari 348 TB? In the past, managing alternative assets often required private banks or other specialized service providers.

- Limited access: An investor’s alternative asset allocation may be insufficient to buy a Rolex watch or other investment outright. But even if they have the money, they may still have to sign up to a waiting list or wait until the desired item becomes available on the public market.

Fractional investments, which are now fully regulated in Switzerland and the European Union, help to overcome the first big roadblock for retail investors. For example, one can now invest 50 francs in a 500-franc artwork and, as its legal co-owner, benefit proportionately from growth in the asset’s value.

The second and third roadblocks to investing in alternative assets are now being solved by financial organizations that provide expertise and manage assets on behalf of fractional investors.

What are the unique benefits of alternative investments?

Alternative investments can be purposed in a number of different ways, depending on your stock portfolio and investment strategy:

- Hedge against inflation: High-quality diamonds and platinum bullion, for example, have historically shown monthly volatility of less than three percent. Their correlation to global equities markets is less than 0.26 (source: Bloomberg).

- Increase your wealth: According to Knight Frank’s Luxury Investment Index, alternative asset classes like art, rare whisky, and luxury watches had average returns of over 10 percent per annum over the past decade, often outperforming the DAX 40 and the S&P 500.

- Invest based on your values and interests: From sustainable companies to hobbies (stamps, vintage cars, or Lego, for example), many alternative asset classes can be used for passion investing – investing based on your values and interests.

How do alternative investments perform compared to other asset classes?

As stated above, alternative assets are very diverse. Certain alternative asset classes have very low volatility and potential returns of 2-3 percent per year, while other, riskier classes (artworks from up-and-coming artists, for example) have yielded performance of over 20 percent, in some cases. So potential performance depends on your risk tolerance and overall investment strategy.

To offer an example, over August 2024 many assets on Splint Invest had higher performance than the S&P 500 (+3.9 percent) and the DAX (+2.2 percent), among others. The value of an artwork by emerging artist Raghav Babbar, for example, grew six percent over that period.

What is your advice for investors considering alternative assets?

For those new to alternative investments, the most important advice is to diversify your alternative asset portfolio by investing in a variety of different asset classes. Unless you are ready to spend a significant amount of time learning about different asset classes and finding prospective investments, I recommend partnering with a credible intermediary to manage your investments.

Splint Invest (UID: CHE-317.401.567), the biggest player in this niche in Switzerland, understands the challenges. It provides easy access to a range of alternative assets for private investors looking to diversify their investment portfolios.

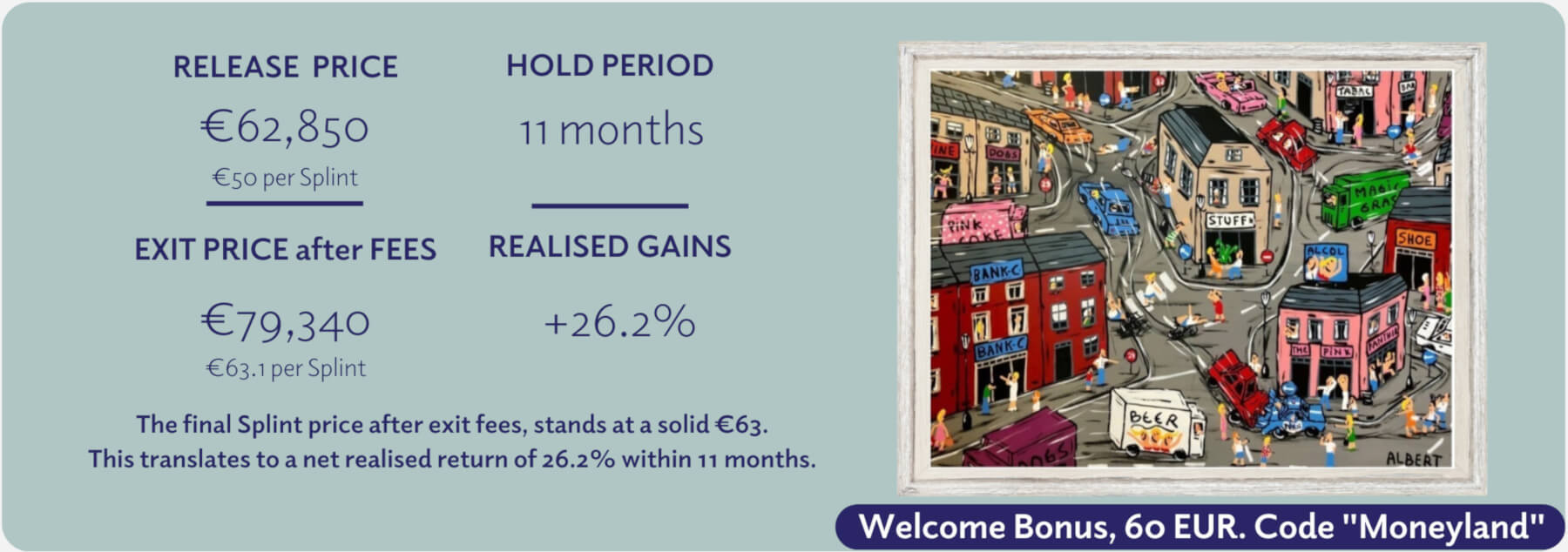

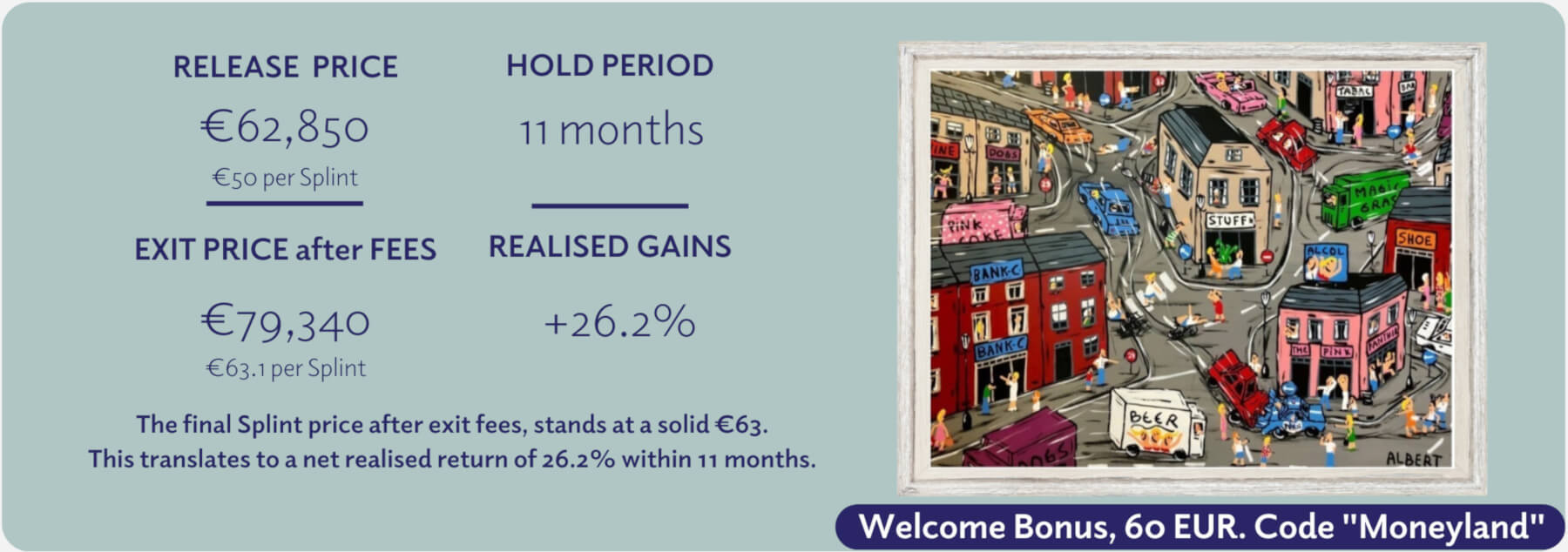

Splint Invest* is a registered financial institution in Switzerland, regulated by VQF (Nr. 100956). In addition to Switzerland, our app-based investment service is also used by investors in the UK and the EU. You can begin investing from just 50 euros. You simply fund your account and invest the money into fractional ownership shares (Splints).

*Splint Invest is a brand. The regulated company that operates the Splint Invest platform is MARK Investment Holding AG.

With more than 30,000 registered investors and over 18 million euros under management, Splint Invest already offers more than 10 alternative asset classes. Several more will be added this year. You can download the Splint Invest app, create an account, and begin investing in alternative assets – all in less than 2 minutes.

We are glad to offer new users a 60 euro welcome bonus with the code Moneyland * – so they can test the whole process without investing their own money. Click the link to download the app. You can the find Splint Invest app on Apple’s App Store and on Google Play, or use the web portal on www.splintinvest.com.

*Offer is valid for new users only.