What is Neon?

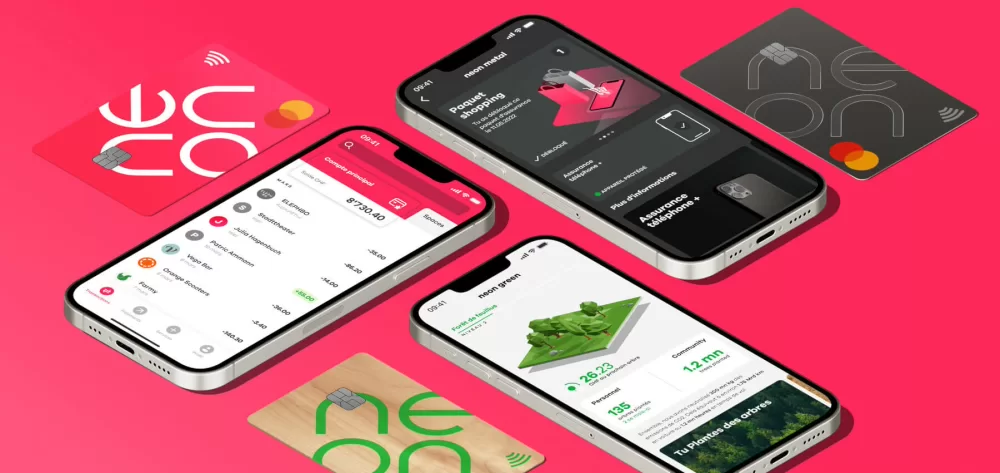

Neon is a Swiss neobank which offers its services exclusively via a mobile app. It offers a Swiss private account with a linked Mastercard card. Customers can also invest in a selection of securities. The bank account is maintained by the Hypothekarbank Lenzburg.

What services does Neon provide?

Neon offers an account and a Mastercard card.

The Neon account can be used to receive incoming bank transfers and deposits (a salary, for example). It can also be used to pay bills and pay for purchases from brick-and-mortar and online merchants.

Neon also lets you invest in select stocks, and hold them in a custody account.

Is the Neon account secure?

The private account which you get with Neon is a real Swiss bank account at the Hypothekarbank Lenzburg. The Hypothekarbank Lenzburg is a fully-licensed Swiss bank and is covered by Swiss bank depositor protection.

This means that in the unlikely event of the bank going bankrupt, account balances are guaranteed up to a maximum of 100,000 francs per customer. You can find more information about Swiss depositor protection insurance here.

Is Neon a Swiss bank?

Neon is not a bank. Neon works with the Swiss Hypothekarbank Lenzburg, which maintains individual private accounts for each Neon user.

What does Neon cost?

Neon has three different offers:

- Neon Free: There are no monthly account fees. The card has a one-time issuing fee of 20 francs. Incidental fees apply to certain services, such as international transfers.

- Neon Green: You pay a 5-franc basic monthly account fee. For every 500 francs which you spend using your Neon Green card, Neon has a tree planted.

- Neon Metal: This account has a 15-franc monthly fee. An interesting feature of this account is that the linked debit card is made out of metal and weighs 22 grams. You get five complimentary Swiss franc cash withdrawals at Swiss ATMs per month, and unlimited cash withdrawals outside of Switzerland.

Which cards does Neon offer?

Neon accounts come with a Mastercard card. Before mid-September 2024, Neon customers received Mastercard prepaid cards.

The card that customers previously received was technically a prepaid credit card, but it functions almost exactly like a debit card. You do not have to load the card before using it. Charges to the card are debited directly from your Neon bank account.

Neon does not offer any alternative cards such as credit cards or Maestro debit cards.

Can I make international transfers with Neon?

You can make international money transfers to bank accounts in over 40 different countries. These include many European countries and other countries like the United States, Canada, Australia, Brazil, Thailand and Singapore.

Neon partners with peer-to-peer transfer service Wise (TransferWise) for international transfers. When you use Neon to make international transfers, you pay the Wise fee plus a Neon service fee for the convenience.

Transfer fees vary depending on which country and currency you transfer money to. For example, if you were to send the equivalent of 100 francs to a Eurozone country like Germany, you would pay around 1.38 francs in fees. Neon clearly shows the fee right in the app when the transfer is made.

Neon offers these advantages compare to other international transfer providers:

- Currencies are exchanged at favorable interbank rates with no markup.

- In many cases, the money gets to the recipient much faster than it would with conventional bank transfers. Transfers to many Asian countries, for example, can take as little as several minutes.

What currency exchange rates does Neon use?

Neon does not add markups to currency exchange rates like bank typically do.

Mastercard interbank rates are used for payments in foreign currencies with the Neon card.

Reuters interbank rates are used for international transfers from the Neon account.

Does Neon charge foreign transaction fees?

Neon does not charge a foreign transaction fee when you use the Neon card to pay for purchases from foreign merchants.

For incoming transfers in foreign currencies, Neon adds a foreign transaction fee of up to 1.5%.

Neon typically charges a foreign transaction fee of between 0.4% and 1.3% depending on the currency and country.

What do cash withdrawals cost?

Neon users can make two free cash withdrawals at any Swiss ATMs every month with the Free and Green accounts, and five local withdrawals per month with the Metal account. Each additional cash withdrawal costs 2 francs. When you make cash withdrawals at ATMs outside of Switzerland, you pay Neon a fee equal to 1.5% of the amount withdrawn with the Free and Green accounts. With the Metal account you do not pay Neon a fee for cash withdrawals outside of Switzerland.

You can also link your Neon account to Sonect – an app-based cash withdrawal service. You can then use Sonect to make unlimited cash withdrawals from your Neon account at K kiosks, Volg supermarkets and many other retail outlet and food delivery services. Cash withdrawals from Neon using Sonect are free of charge.

Can I make mobile payments with Neon?

Yes. Neon supports a number of mobile wallets.

The Neon card can be linked to the Google Pay Samsung Pay, and Apple Pay mobile payment services.

Can I use Twint with Neon?

Neon users can use the prepaid version of Twint. However, there is not special version of Twint for Neon. This means you cannot link Twint directly to your account to have charges and transfers debited from your Neon account balance. The UBS Twint app provides an alternative, as you can link the Neon Mastercard to UBS Twint to have your account debited via the Neon card.

How much does the Neon card cost?

If you use Neon Free, you pay a one-time 20-franc issuing fee when you get your card.

There is no annual card fee. A replacement card costs 20 francs with the Free and Green accounts and 80 francs with the Metal account.

If you use Neon Green, you do not pay a one-time issuing fee for a plastic card. However, you have the option of getting a wooden card for a one-time fee of 20 francs.

Does Neon limit transactions?

Neon has a daily limit of 30,000 francs for bank transfers.

Transactions with the Neon card are limited to 5000 francs of online purchases and 5000 francs of brick-and-mortar purchases per month. Cash withdrawals are limited to 1000 francs per day. Total card transactions are limited to 10,000 francs per month.

Can I overdraw a Neon account?

No. Account overdrafts are not possible.

Does Neon offer standing orders?

Yes. Neon users can set up standing orders. These are helpful for recurring transactions when each recurring payment is identical.

Does Neon offer eBills and direct debit orders?

Yes. Neon provides both direct debit orders and eBills.

Direct debit orders grant a third party permission to draw on your bank account. These are useful for the payment of recurring bills when each recurring payment is not identical.

An eBill is a billing method by which you receive bills electronically directly in the Neon app. You can then choose to pay the bill directly from your account – or not to.

Does Neon offer savings accounts?

No. Neon currently focuses on its private account and card. It does not currently offer other banking products like savings accounts. Neon does offer pillar 3a retirement saving solutions in partnership with other service providers.

Neon has a feature called Spaces. These Spaces are sub-accounts that can be used to save. They are not actual savings accounts and do not have their own IBAN. Money kept in Spaces earns interest.

Does Neon offer investment services?

Yes. Neon lets you invest in certain securities like stocks, and hold these in a custody account. However, the selection of securities that you can invest in with Neon is small.

Do I get a Swiss bank account number with Neon?

Yes. Each Neon account has a unique Swiss bank account number. As with other Swiss bank accounts, you get an IBAN which can be used to send and receive transfers both within Switzerland and internationally.

What are the advantages of Neon?

Neon offers a Swiss private account and a Mastercard. The account is protected by Swiss bank depositor protection. The Mastercard can be used for both brick-and-mortar and online purchases.

A major advantage of Neon over other Swiss bank account is that it has low fees and favorable currency exchange rates.

How does Neon Green work?

For every 500 francs which you spend with the Neon Green Mastercard, Neon has a tree planted.

Neon does not plant the trees itself, but partners with Eden Reforestation Projects. On behalf of Neon, this organization plants mangrove trees in countries like Kenya, Madagascar, and Mozambique.

What are the disadvantages of Neon?

Neon does not have any branch offices. If you primarily use online banking this should not be a big issue. Cash deposits into your account can only be made by postal deposit slip, and you have to cover the fees yourself.

Probably the biggest disadvantage of Neon applies to users who prefer to get all their services with one provider. Neon does not offer a broad range of services like most established Swiss banks do.

More on this topic:

Compare Swiss private accounts and debit cards now

Neon Free: redeem your coupon code now

Neon Green: Open an account now

Deal of the Day

Deal of the Day